Daily Market Update (June 9th, 2023)

North American active rigs increase, Euro area enters technical recession and equities were generally flat on the day in anticipation for next week's FED rate decision.

· Euro area enters technical recession as two successive quarterly GDP declines are reported by Eurostat.

· North American rig counts tick upwards by 38 rigs on a weekly basis - still down by 43 rigs vs prior year.

· Muted U.S. equities performance suggests anticipation for next week’s FED rate decision.

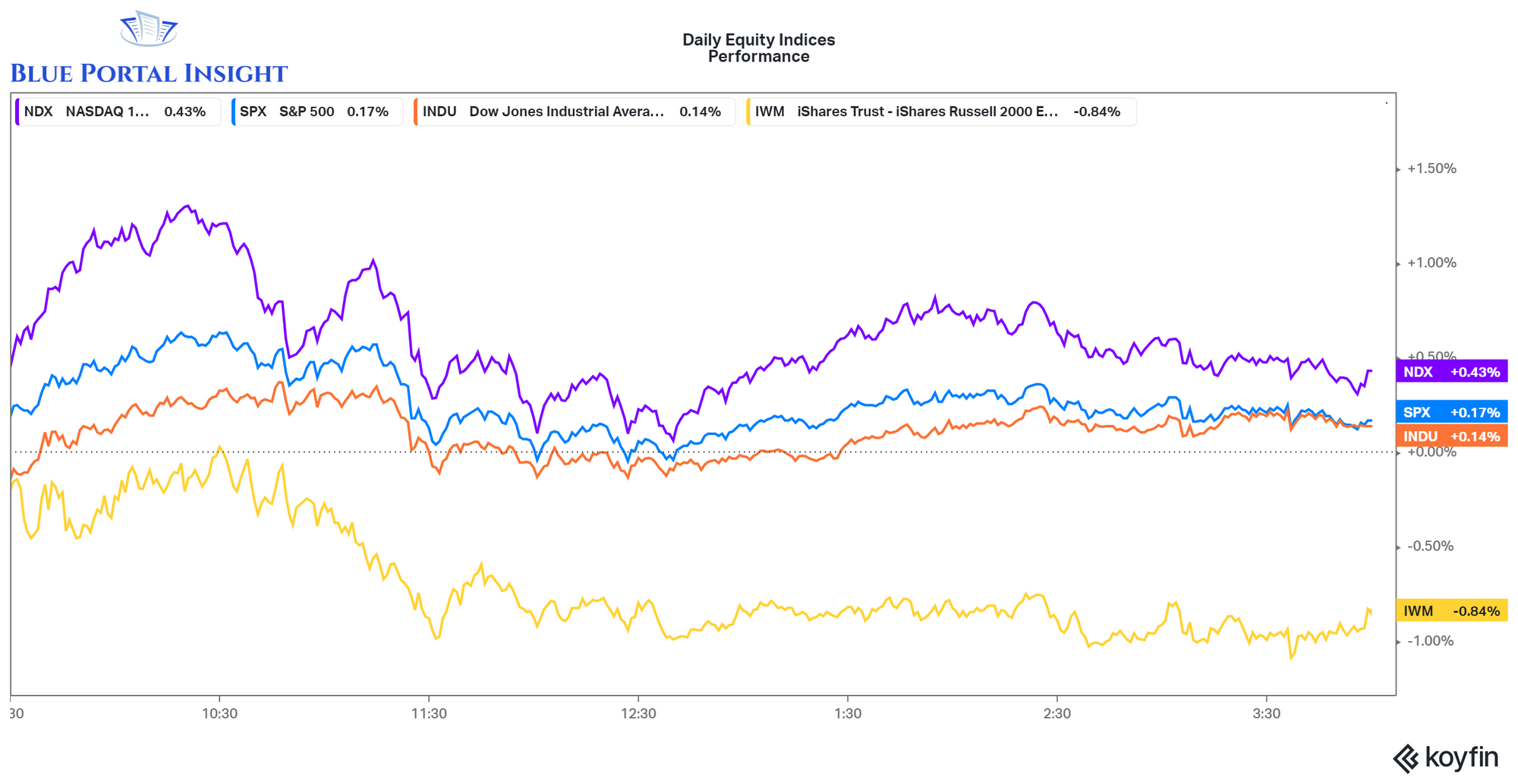

U.S. Equities

Equities were generally flat on the day with the Nasdaq 100 leading the performance by being up 43 basis points on the day. The SP500 and the Dow continued to trade close to each other and have not produced significant momentum in either direction in the last 6 days and were up 17 and 14 basis points on the day, respectively. The Russell 2000 is traded downwards by 84 basis points. Muted performance in neither direction likely suggests that traders are looking ahead to next week’s FED meeting and rate decision for guidance on the state of the economy.

Euro area enters technical recession

In the first quarter of 2023, seasonally adjusted GDP decreased by 0.1% in the euro area, compared with the previous quarter, according to an estimate published on June 8th by Eurostat, the statistical office of the European Union. In the fourth quarter of 2022, GDP had decreased by 0.1% in the euro area.[1]The combination of two successive quarterly GDP decreases usually indicates that the region has entered a ‘technical recession’. Though European equities are down slightly on the day, it is possible that the technical recession could make European Central Bank policy makers more hesitant to continue hiking rates in their next meetings.

Baker Hughes Oil Rig count

The Baker Hughes weekly rig count was released on Friday showing an increased rig count across North America by 38 rigs. With the additional 38 active rigs, the number of active across North America now stands at 831, down by 43 rigs compared to the prior year. The net added rigs of 38 was a result of 39 net added rigs in Canada, -1 in U.S. and 0 in the Gulf of Mexico.

Though the weekly change should be positive news for the moderation of oil and gasoline prices, the oil rig counts are still lower versus the prior and considerably lower than pre-pandemic levels. In addition, the Energy Information Administration (EIA) reported earlier in the week lower commercial inventories of crude oil versus the prior week by 0.5 million barrels. The current commercial inventory levels of U.S. crude oil and gasoline inventories are down by 2% and 8%, respectively, below their five-year averages for this time of year.

Oil prices may remain stickier to the upside as consumption picks up during the summer driving season in the US and as China experiences its first summer vacation season without any Covid-19 restrictions.

Please feel free to follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or equally licensed professional.

[1] EuroStat - euroindicators - June 8th, 2023