Daily Market Update (June 16th, 2023)

European equities moved higher as ECB raises rates, U.S. treasury rates yield curve remains inverted near record levels and Gold prices remain high even though U.S. bank equities recover losses.

· European equity indices moved higher after yesterday’s ECB decision to raise interest rates by 0.25%.

· U.S. Treasury rates move higher and yield curve still remains inverted near record levels.

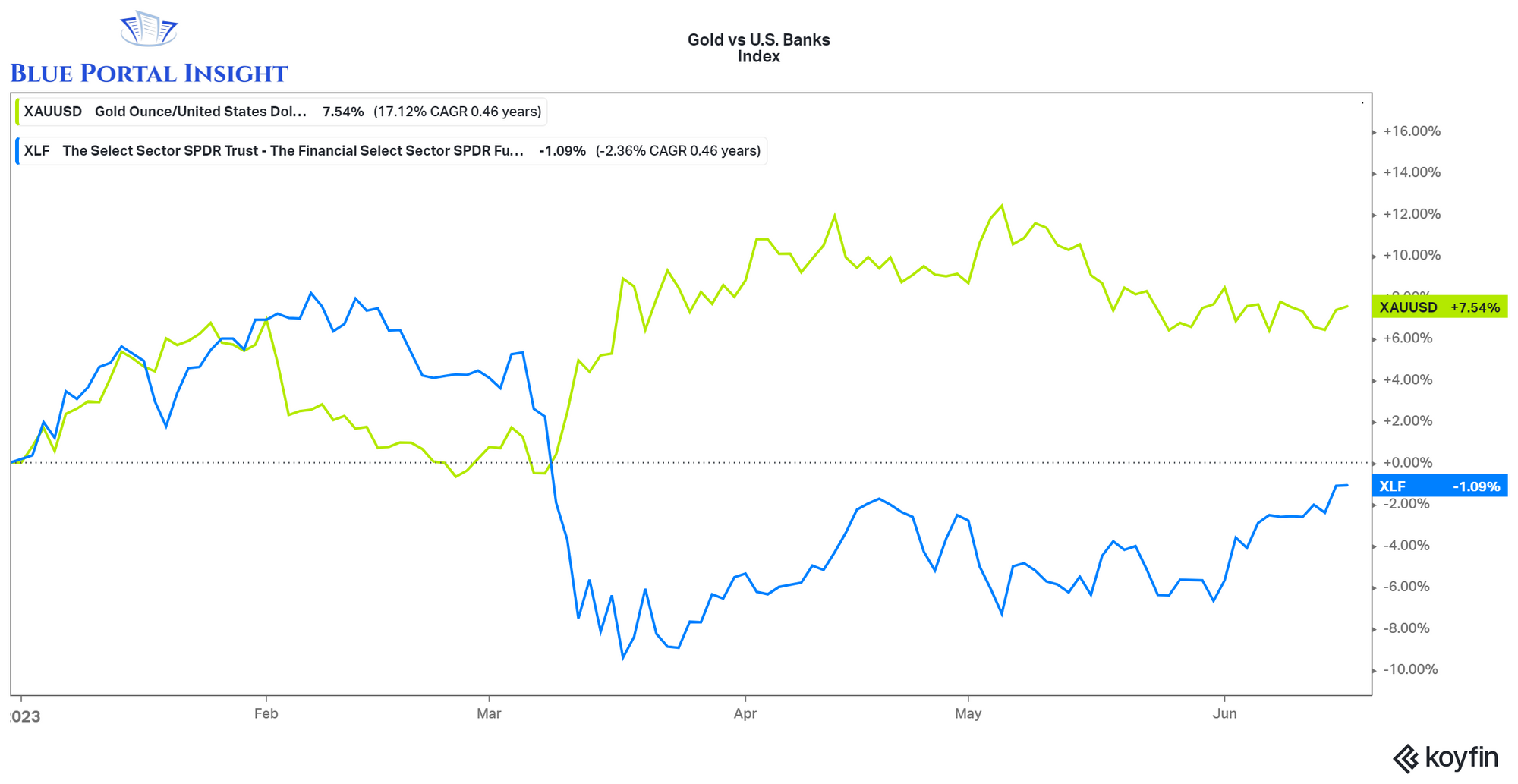

· Gold prices are up 7.49% year-to-date while U.S. bank equities struggle versus other sectors of the equity market but move towards year-to-date positive numbers.

European Equities edge higher after ECB rate hike.

European equities end the day on a higher note as the FTSE 100, the DAX and the Euronext 100 all end up higher by +0.27%, +0.54% and +0.77%respectively. The move higher comes after yesterday’s release by the European central bank to increase their interest rates by 25 basis points – a decision different from that of the Federal Reserve who decided to pause rate hikes in their last meeting and the People’s Bank of China who cut rates by 10 basis points. Year-to-date the Nasdaq 100, SP500 and the Dow are up 31.8%, 15.5% and 4.1% respectively.

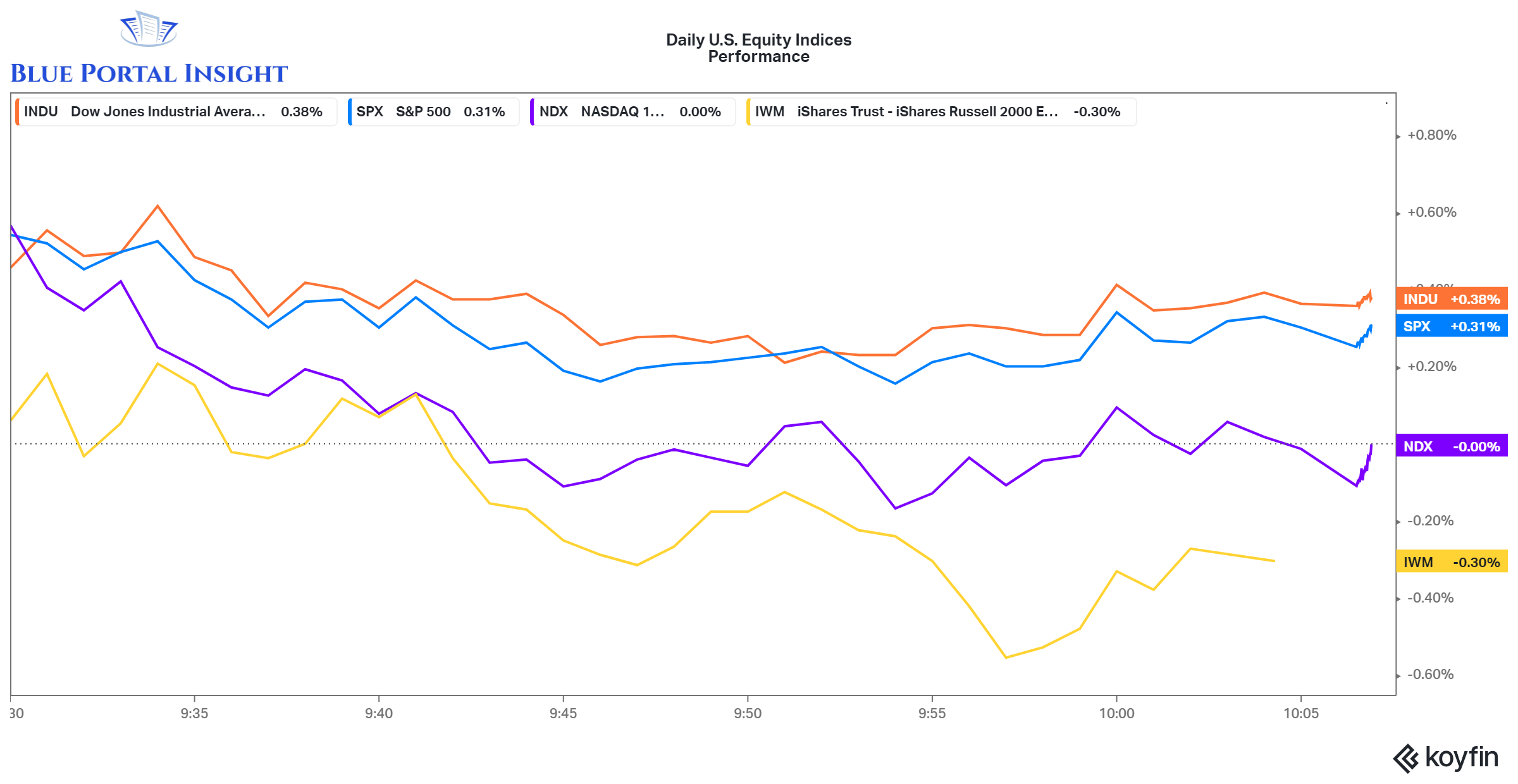

U.S. Equities open flat on U.S Trading day

U.S. equity indices open somewhat flat on the day. The Russell 2000, Nasdaq 100, SP500 and Dow Jones were up/down by -0.30%, +0.00%, +0.31% and +0.38%, respectively, at the time of this report.

U.S Treasury rates edge higher

Longer dated treasury rates move higher: 10YR and 30YR treasury rates are up by 6 and 4 basis points, respectively. Shorter term U.S. treasury rates move higher: 3-Month, 1YR and 3YR are up by 1, 6, 11 basis points respectively.

The U.S. treasury yield curve is still inverted and has remained so for the last 7 months. As of yesterday, the 10YR treasury rate minus the 3-Month Treasury rate stood near record negative levels at -1.61%.

Commodities

WTI and Brent Crude prices edged higher by +0.6% and +0.4%and are now priced at $71.10 and $76.04, respectively, at the time of this report.

Year-to-date, the number of rigs actively drilling for crude oil and natural gas in the U.S. is down 11% to 695. This figure is also 12% lower compared to the number of active drilling rigs reported on March 6th, 2020, before the Covid-19 pandemic began. The Baker Hughes North American oil and gas rig count will be released later today, which should give further insight into whether supply will continue to tighten or alternatively ease if rig counts tick upwards.

Gold is slightly up on the day by 11 basis points. Year-to-Date, Gold is up +7.49%. In the chart below you’ll see the performance of Gold versus the U.S. banks ETF, XLF. The flight from U.S. bank equities, the lack of confidence in the U.S. banking system, and the deposit flights and bankruptcy of Silicon Valley Bank and Credit Suisse all occurring in March coincided with an influx of demand for gold and precious metals. And even as U.S. bank indices are returning towards year-to-date positive performances, gold prices have remained somewhat unchanged, suggesting full confidence in the banking system is yet to return.

SEC Charges PIMCO for Disclosure, Policies and Procedures failures

The Securities and Exchange Commission today announced that registered investment adviser Pacific Investment Management Company LLC (PIMCO), subsidiary of the Allianz Group, will pay $9 million to settle two enforcement actions relating to disclosure and policies and procedures violations involving two funds PIMCO advises.

The SEC found that, from September 2014 to August 2016, PIMCO failed to disclose material information to investors concerning the use by PIMCO Global StocksPLUS & Income Fund (PGP) of interest rate swaps and the material impact of the swaps on PGP’s dividend.

In the second action, the SEC found that, from April 2011 to November 2017, PIMCO failed to waive approximately $27 million of advisory fees as required by its agreement with the PIMCO All Asset All Authority Fund.[1]

Please feel free to follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or equally licensed professional.

[1] SEC