Daily Market Update (June 14th, 2023)

The Federal reserve pauses rate hikes for the first time in 2+ years, equities end up mixed and Euro and British pound appreciate versus the U.S. Dollar.

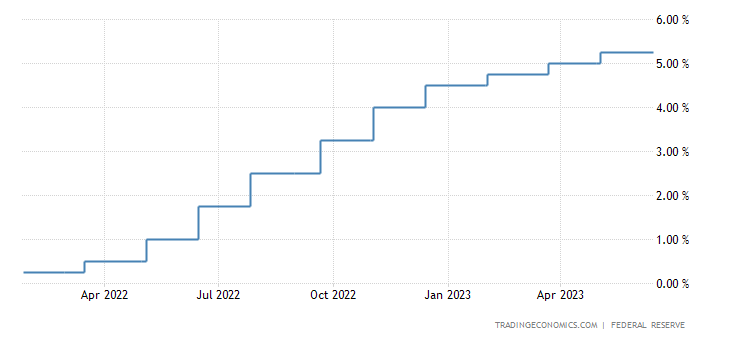

· The Federal reserve left the FED funds rate unchanged at 5.00-5.25% for the first time since it began its hiking cycle in early 2021

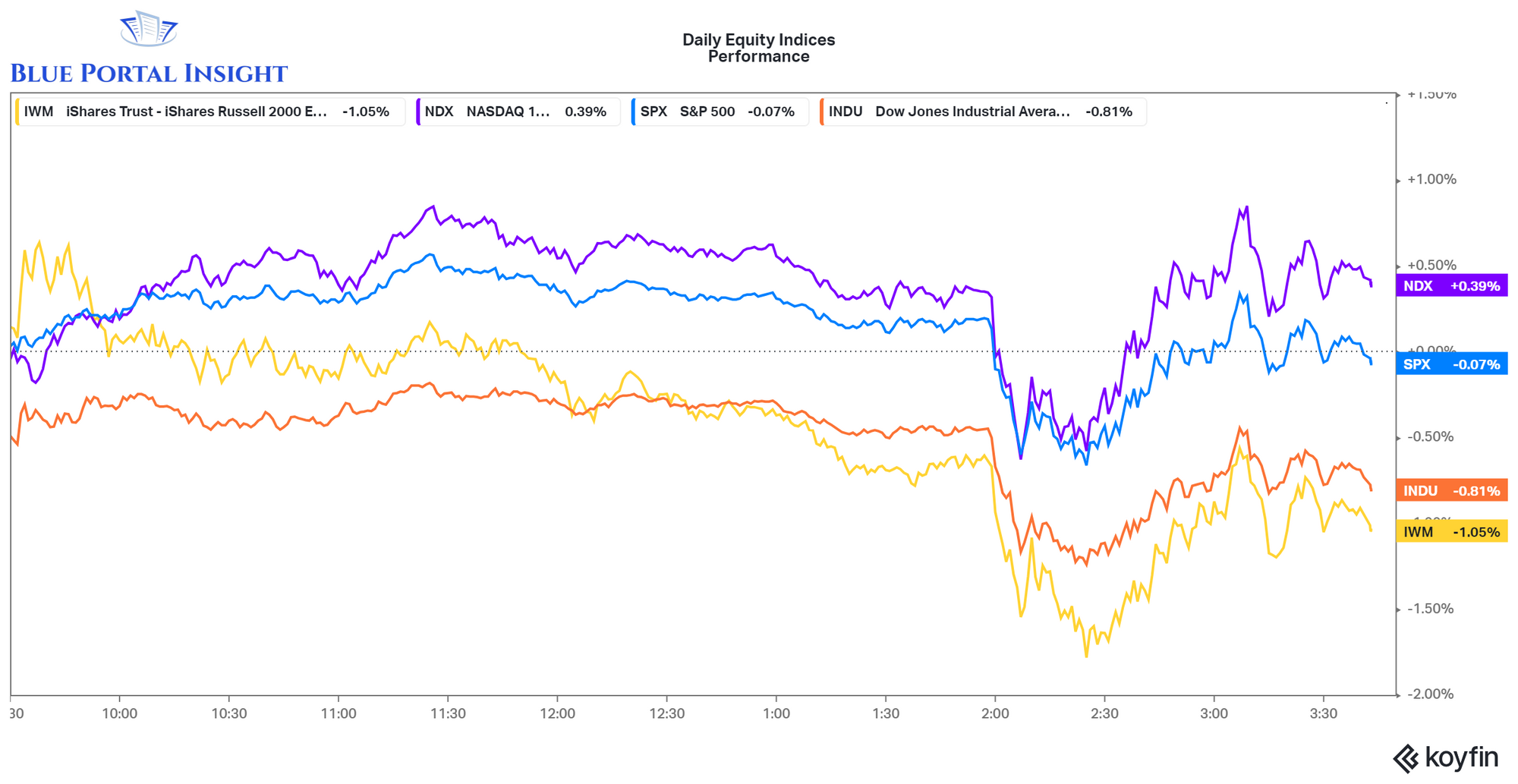

· Equities ended mixed with the Nasdaq 100 leading the way.

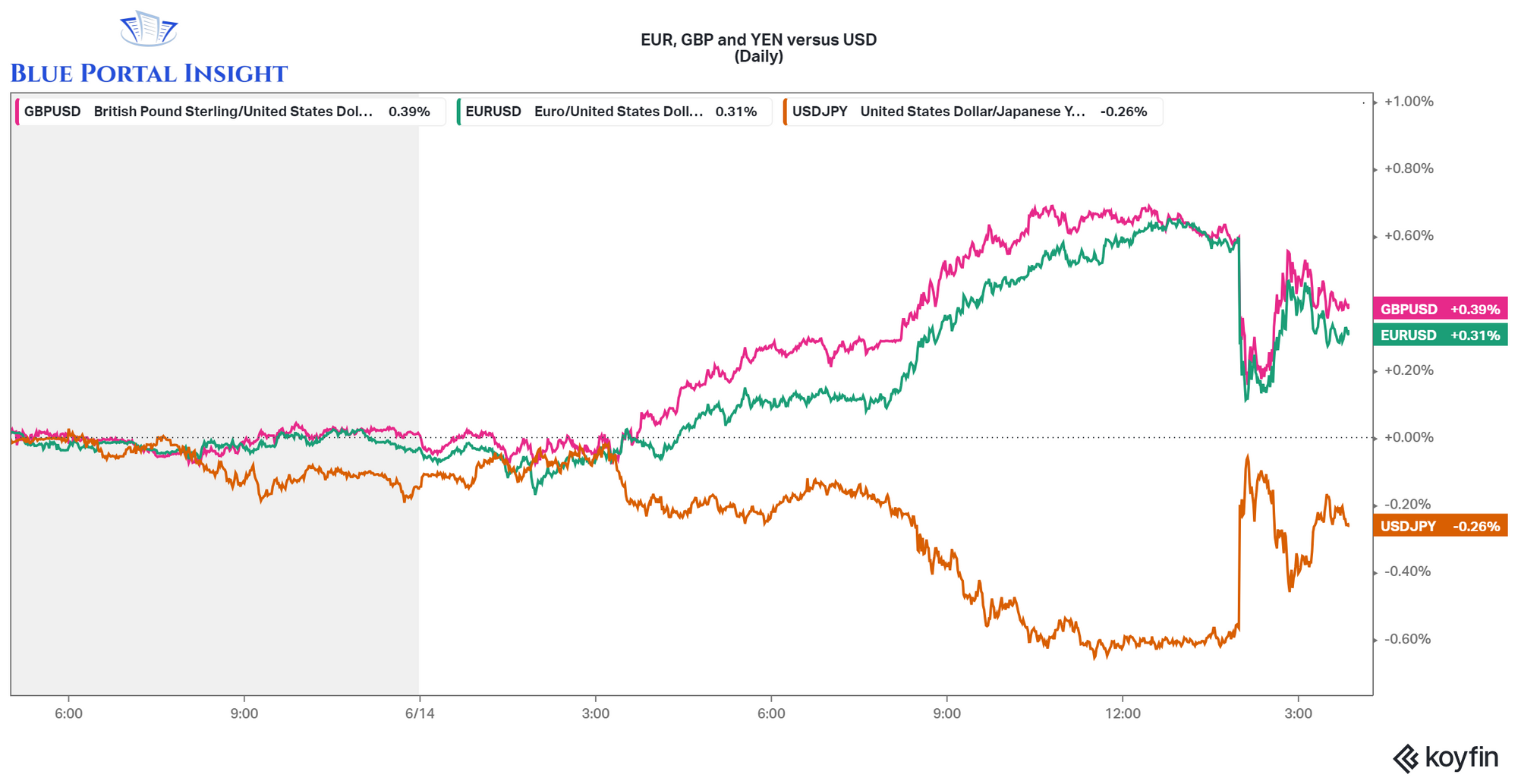

· Foreign exchange markets saw the Euro and the British Pound appreciate vs the U.S. Dollar, while the Japanese Yen depreciated.

FED Decision

The Federal Reserve (the FED) left their rate policy unchanged as the Fed’s funds rate remained at 5.00% - 5.25%. The decision comes in after the U.S. inflation rate (CPI) report came out yesterday with all-items CPI and Core CPI reporting at 4% and 5.3%, respectively. Both all-items CPI and Core CPI are still higher than the FED’s long-term target of 2% but have eased in the last few months.

FED Rate Hikes timeseries

During today’s Powell remarks on economic conditions and justifications for the ‘pause’ in the FED rate hikes, the FED committee disclosed their FED funds rate estimates of 5.6% and 4.6% by the end of 2023 and 2024 meaning that further rate hikes in 2023 are likely to occur in intervals between ‘pause’ decisions (where the Fed decides to leave rates unchanged). An example of a different central bank that has equally employed this method includes the Australian central bank who is struggling to manage its stubbornly high inflation rate still sitting at 7.0% as of March 2023.

This is the first meeting that we’ve seen a rate pause since the beginning of this hiking cycle and as such could be the beginning of easing consumer interest rates in the mortgage, automotive and credit-card markets. We’ll be on the lookout for how these indicators change over the coming weeks.

U.S. Equities

Immediately after the announcement of the FED decision, equity indices dropped sharply lower but rebounded over the next hour and a half. At the time of this report, the Nasdaq 100 leads the way as it is up 39 basis points while the SP500, Dow and Russell 2000 are down by 7, 81 and 105 basis points.

Foreign Exchange (EUR, GBP, JPY)

The Euro and British pound initially appreciated by 60 basis points on the day until the FED rate decision when they both depreciated by 50 basis points and have since rebounded since Powell’s comments. The GBP and EUR now sit 39 and 31 bps higher, respectively, than the USD on the day.

The Yen had the inverse relationship, by initially depreciating by 60 basis points, appreciating at the time of the FED decision and depreciating again during Powell’s comments. It now sits 26 basis points lower than the USD on the day.

Bonds

U.S treasury rates remained relatively flat as the US10YR rate have mixed signals and then settling at 2 basis points lower on the day. Short-term treasuries are flat on the day.

Please feel free to follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or equally licensed professional.