Daily Market Update (June 13th, 2023)

CPI release reports easing 12-month inflation figures, U.S. Equities jump higher on easing inflation news and Euro and British Pound appreciate versus the US Dollar.

· CPI release reports a 0.1% monthly upward change, 4% on a 12-month basis – still above FED long term target of 2%.

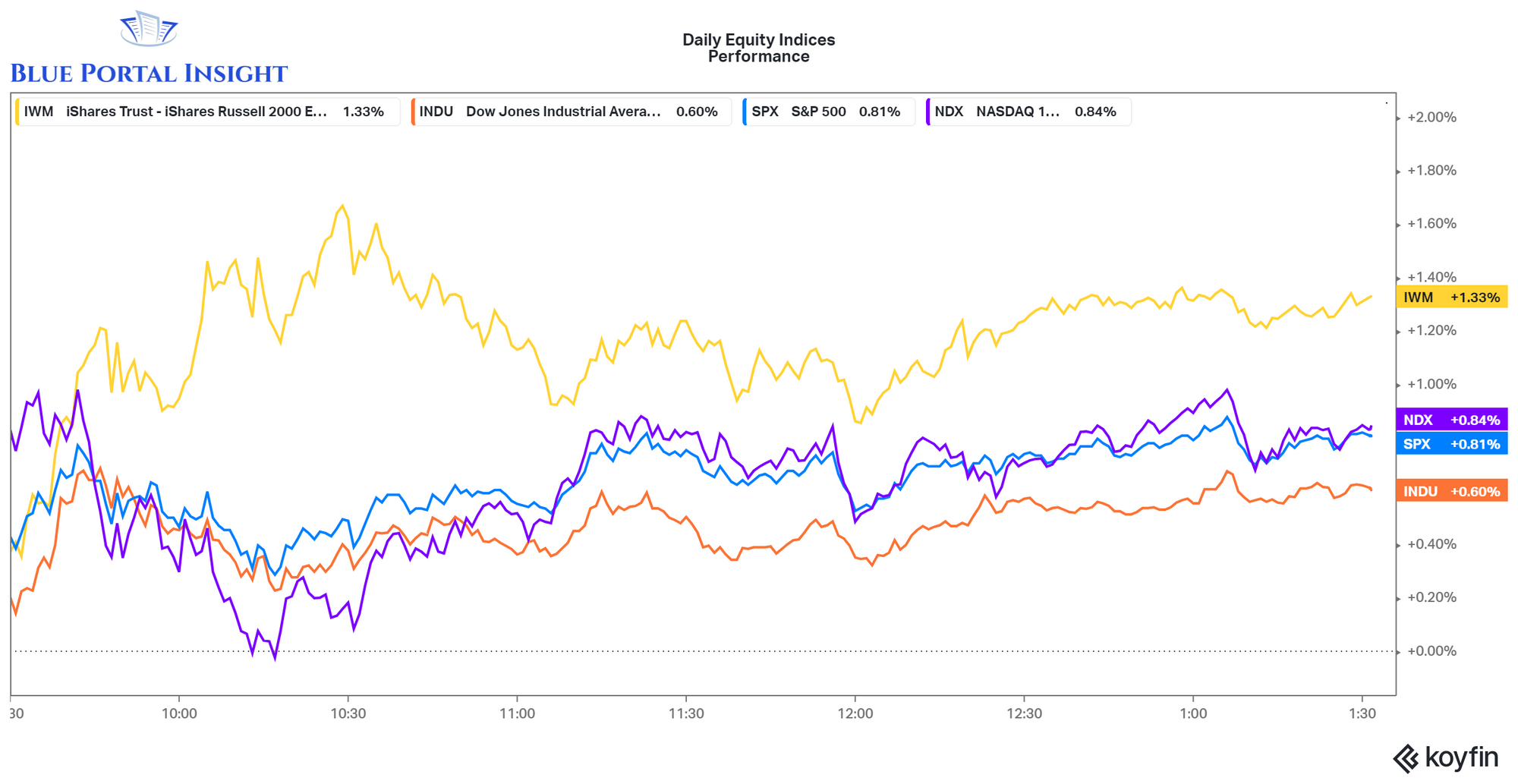

· U.S. Equities moved higher on news of easing 12-month inflation figures. Russell 2000 leads upwards by 133 basis points.

· Euro and British Pound appreciate while Yen depreciates relative to the U.S. Dollar.

CPI

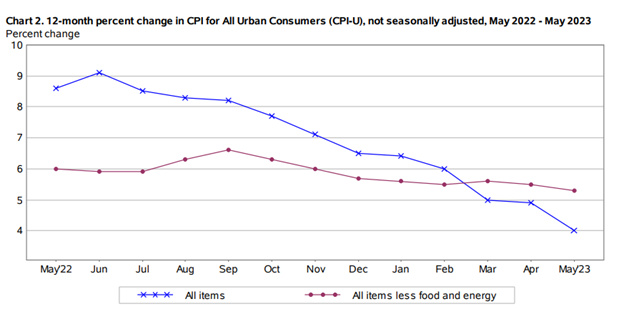

The Consumer Price Index (CPI) for All Urban Consumers (CPI-U) rose 0.1% in May on a seasonally adjusted basis, after increasing 0.4% in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 4.0% before seasonal adjustment.

12-month price changes ending in May for CPI-U ended up at 4%, still above the FED’s 2% long-term target rate. CPI (excluding food and energy) increased 0.4% as it did in April and still sits unabatingly above 5% on a 12-month growth rate basis.

U.S. Equities

U.S. equities moved higher after the CPI report got released. The Russell 2000, Nasdaq 100, SP500 and Dow are all up by 133, 84, 81 and 60 basis points, respectively as of the time of this report.

The CPI figures reported in line with consensus suggest that the market may now be pricing in a higher probability for a FED rate hike pause. The CME Fed Watch tool, which determines the probabilities of changes to the Fed rate and U.S. monetary policy, as implied by 30-Day Fed Funds futures pricing data, is estimating a probability of 92% that the FED is to pause rate hikes and 8% that the FED will raise rates by 25 basis points.

Bonds

10-Year Treasury rates moved higher by 5 basis points after the release of the CPI report and are now trading at 3.79%. Shorter-term rates remain relatively unmoved.

Foreign Exchange

The Euro and British pound appreciated versus to the U.S. Dollar by 31 and 77 basis points, respectively, on the day while the Japanese Yen depreciated versus the U.S. by 37 basis points

Commodities

Brent crude and WTI prices jump 3.5% and 3.6%, respectively, while gold futures are down 0.7% on the day.