Daily Market Update (June 6th, 2023)

Small Cap stocks move higher, US largest Crypto exchange, Coinbase, is charged by SEC, and metal prices ease.

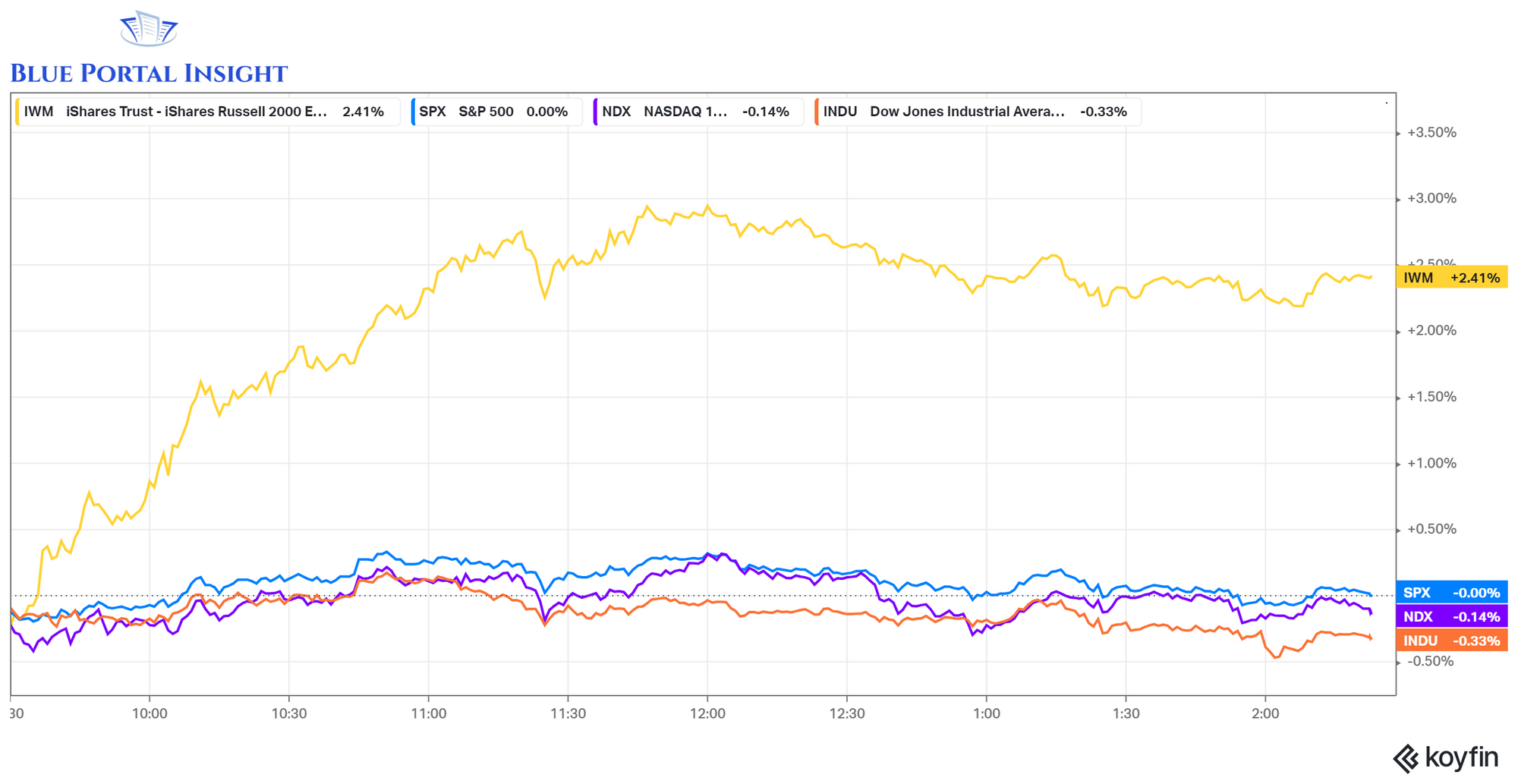

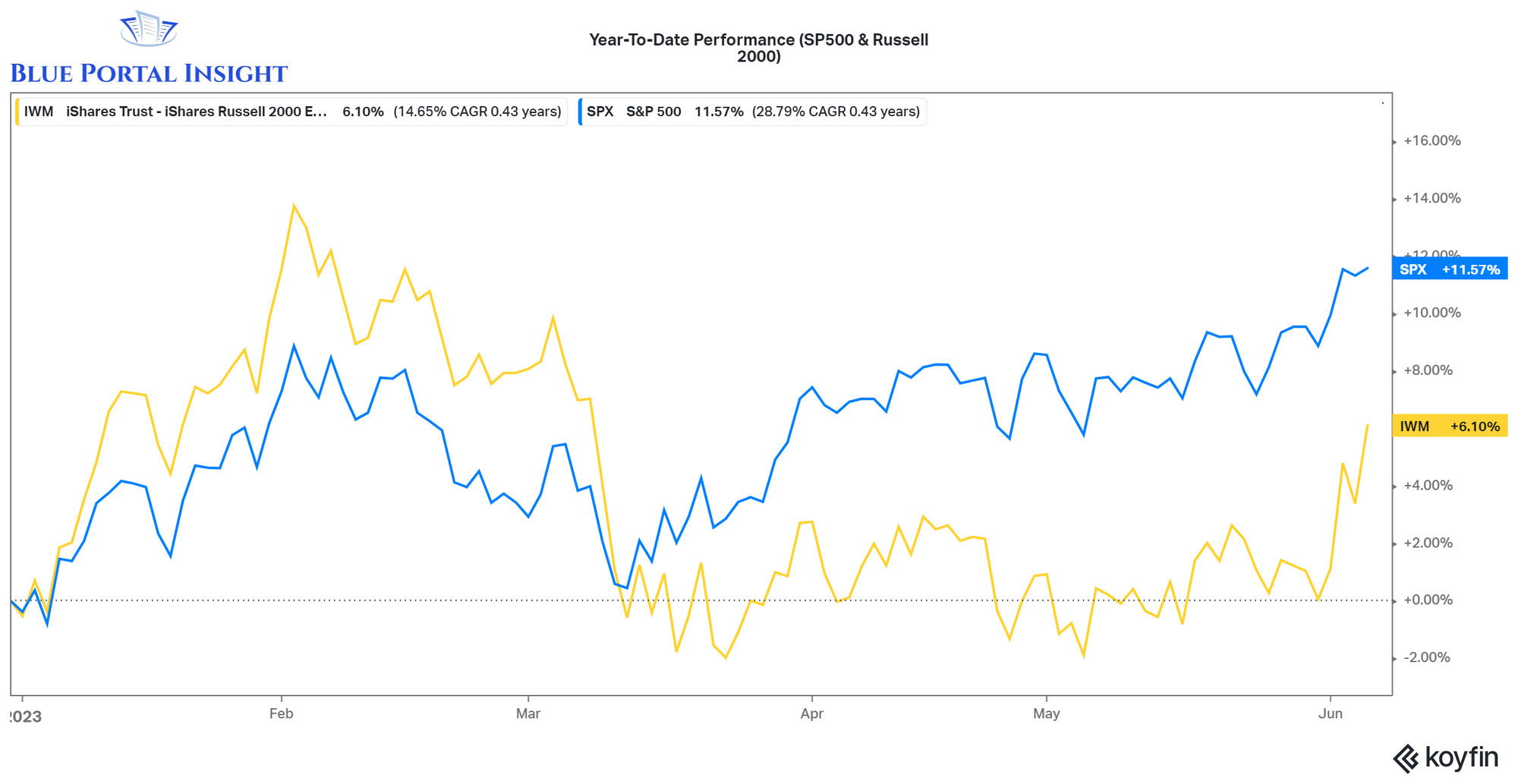

· S&P500, Dow and Nasdaq flat while Small Cap index moves higher on possible earnings beat for the quarter.

· SEC announced Tuesday that is has charged US’s largest crypto exchange, Coinbase, on counts of unregistered operation as an exchange, broker-dealer and clearing agency.

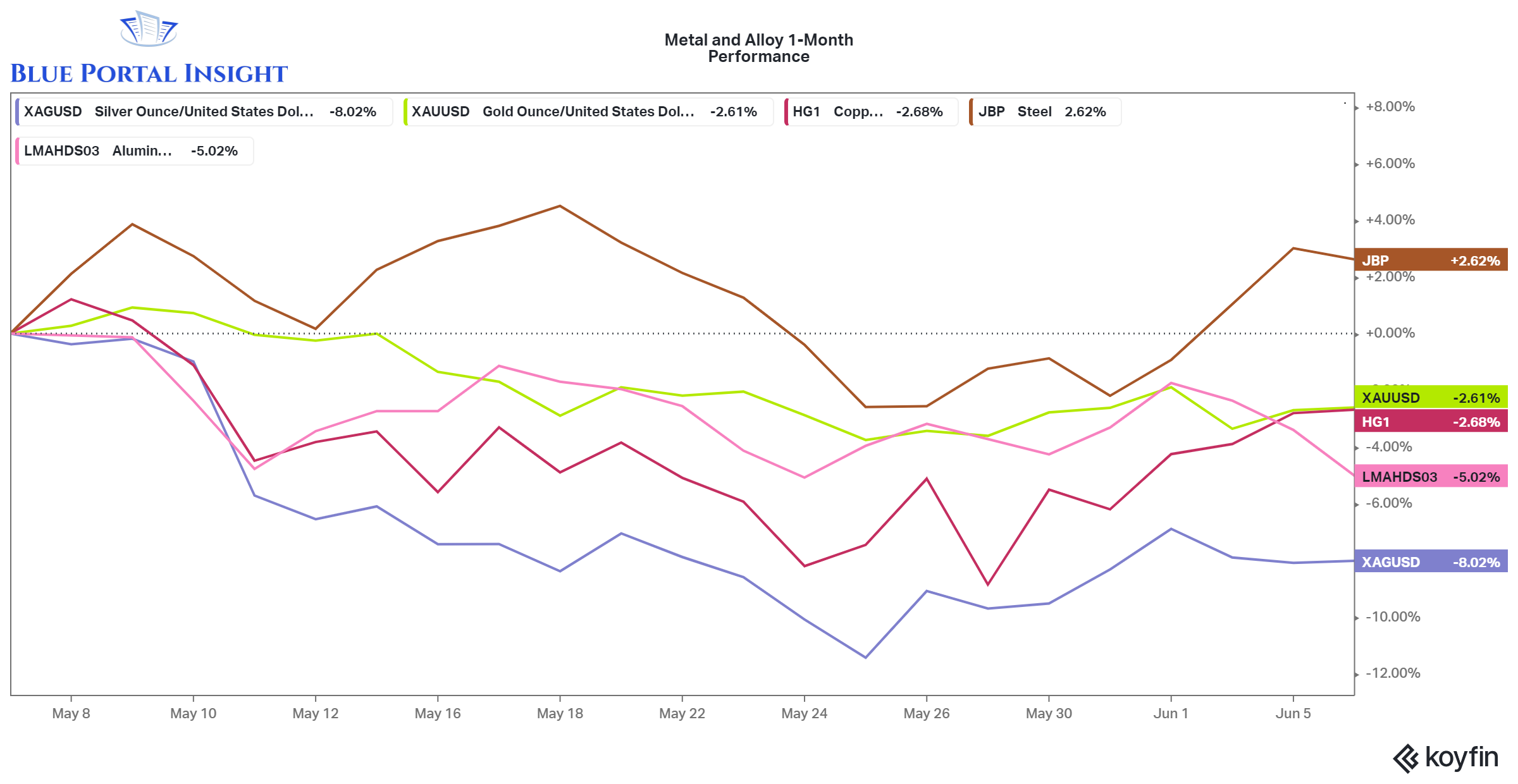

· Metal and Alloy prices are generally down for the month, with gold prices easing since deposit confidence in US banks is being restored.

Equities

Equity indices are trading mostly flat, with the SP500, Dow and the Nasdaq all trading within 50bps of each other. However, the Russell 2000 is up over 240 basis points on the day. Year-to-date, the SP500 has outperformed the small-cap index by over 500basis points, thus, with financial markets still in no-man’s-land in terms of knowing how the FED will react to the most recent economic reports on unemployment and inflation, small cap investors bets on a particular FED direction are unlikely. Nonetheless, The World Bank just released its half-year Global Economic Prospects report showing higher than expected growth and consumption in the region; thus, small cap investors are possibly positioning themselves to what could turn out to be higher than expected earnings releases across the board for smaller cap equities.

Crypto

Following yesterday’s announcement by the SEC to charge Binance and its founder on multiple counts of financial misconduct, the SEC announced this Tuesday that it will also be charging the largest US cryptocurrency exchange, Coinbase, with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. In addition, The SEC also charged Coinbase for failing to register the offer and sale of its crypto asset staking-as-a-service program. Coinbase’s stock (NYSE: COIN) is trading -13.09% down on the day.

Commodities

Aluminum has led the decline in metal prices by being down 167bps on the day. The world’s most precious and traded metals are on a decline over the past month with Gold, Silver, Copper and Aluminum down -2.61%, -8.02%, -2.68% and -5.02%, respectively. Steel is the outlier by being up 2.62% on the month. Gold, specifically, performed significantly well as a flight to safety during the March bank runs on regional Californian banks and the now failed multinational Credit Suisse. Confidence has been slowly restored in the banking industry and the price of gold has since subsided by 4.22% from its yearly high.

Please feel free to follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or equally licensed professional.