Daily Market Update (June 5th, 2023)

Keep up to date with today's daily market update where we briefly cover movements across major markets and news to keep you in the loop.

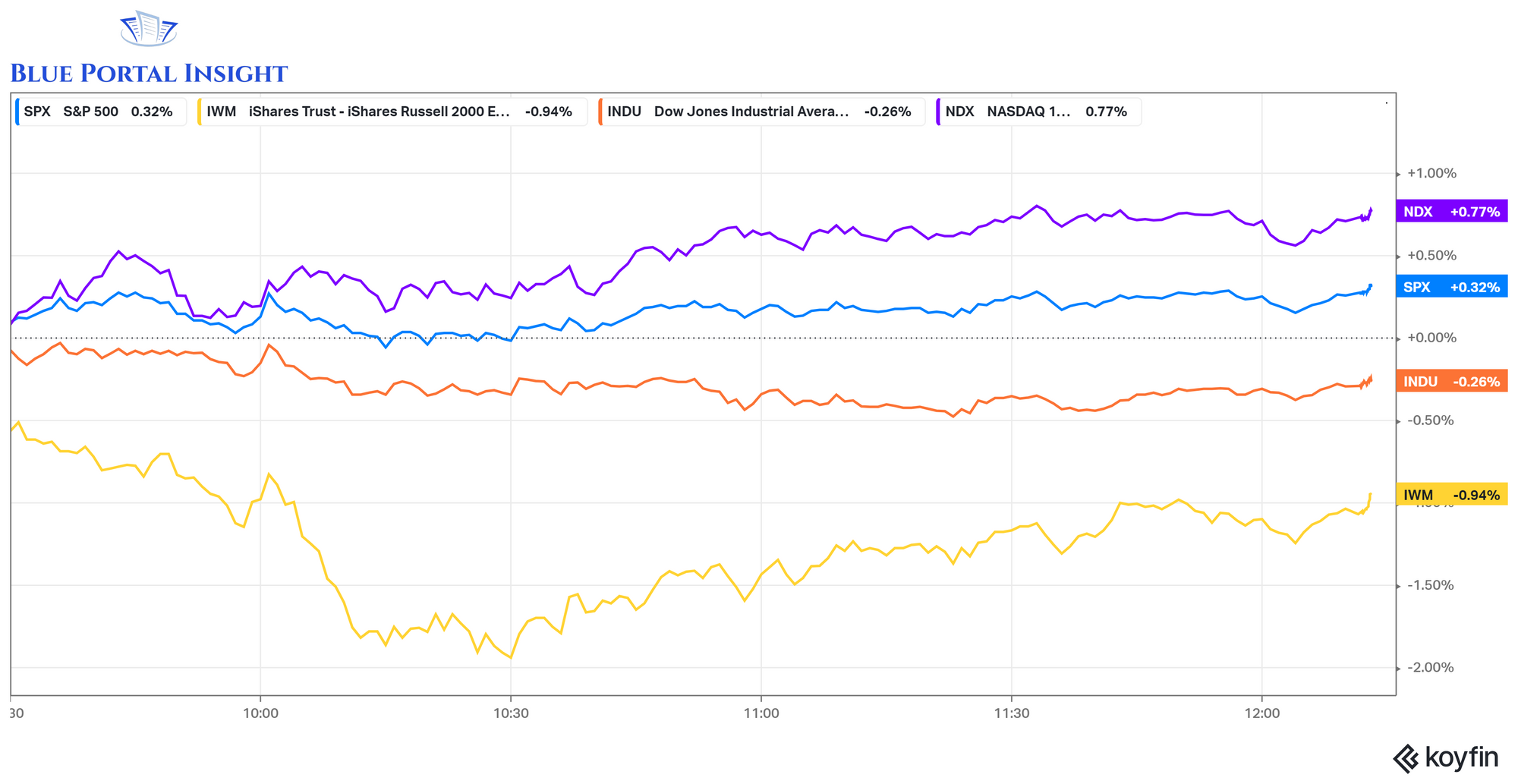

· Equity markets open mainly flat Monday morning, Nasdaq 100 higher than SP500, Dow Jones and Russell 2000.

· Bitcoin prices and publicly-traded cryptocurrency players trading down by +5% on the day as SEC sues Binance and its founder, Changpeng Zhao.

· Oil prices jump slightly off OPEC+ decision on Sunday to cut oil production by 1 million barrels/month going forward.

Equities

- Markets have opened this morning generally flat with the Nasdaq 100 outperforming all other three major indices. Both Nasdaq 100 and SPX opening positively by 77 and 32 basis points, respectively. The Dow and the Russell 2000 are down 26 and 94 basis points, respectively.

SEC sues Binance

- The Securities and Exchange Commission (SEC) today charged Binance Holdings Ltd. (“Binance”), which operates the largest crypto asset trading platform in the world, and their founder, Changpeng Zhao, with a variety of securities law violations. The SEC alleges that, while Zhao and Binance publicly claimed that U.S. customers were restricted from transacting on Binance.com, Zhao and Binance in reality subverted their own controls to secretly allow high-value U.S. customers to continue trading on the Binance.com platform.

- Shockwaves are being felt across crypto markets as publicly-traded peer Coinbase (NASDAQ: COIN) is down 1000bps on the day thus far, crypto market ETF, Bitwise Crypto Industry Innovators (NYSEARCA: BITQ), is down nearly 500bps on the day and spot Bitcoin prices are trading 500bps lower than the prior day.

Commodities

Oil

OPEC+ announced in its 35th OPEC and non-OPEC Ministerial Meeting that it will cut oil production by 1 million (mm) barrels a day in a bid to prop up oil prices. The cut will come mainly from Saudi Arabia who will bring down their production from 10mm barrels/month to 9mm. Equally, Russia, Nigeria and Angola are to also bring down their production targets until further notice.

On Monday, Brent Crude is up 200bps on the day while WTI Crude Oil is up 150 bps on the day. The US sector Energy ETF, XLE, that holds most US oil extractors is flat on the day, trading up only 4 bps from the prior day at the time of this report.

UBS is forecasting Brent crude at USD 95 a barrel by end-2023, up from USD 77.38/bbl at present, in anticipation of a 2 mm barrel global supply deficit that is to come at the end of the year, mainly driven by higher seasonal US consumption of oil during the summer months as guided by the International Energy Agency (IEA).

To receive content straight to your email, don’t hesitate to subscribe for free using the ‘Subscribe’ button on our homepage.

Please feel free to share and follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or an equally licensed professional.