Market Report: Commodities -Lithium

The market for lithium products: What it is, who are the major players, past trends and events, and brief commentary on future industry trends.

The market for lithium products: What it is, who are the major players, past trends and events, and brief commentary on future industry trends.

Report Type: Market Research

Market: Commodities (Lithium)

What is Lithium and why is it important?

Lithium is a highly reactive metal and the lightest of all solid elements. Discovered by Swedish chemist, Johan August Arfwedson, lithium is a critical element used in multiple industrial processes and end products we in our day-to-day.

With 80% of its end usage in 2023 being attributed to batteries, lithium is a critical mineral in the production of rechargeable batteries in electric vehicles and portable electronic devices.[1]It is projected that demand for lithium in battery production will increase by 575% by 2028 vs 2022 levels.[2]

Lithium Market

The lithium market can be divided into (i) lithium minerals for direct use, (ii) basic lithium chemicals, which include lithium carbonate and lithium hydroxide (as well as lithium chloride, from which lithium carbonate may be made), and (iii) inorganic and organic lithium derivatives, which include numerous compounds produced from basic lithium chemicals.

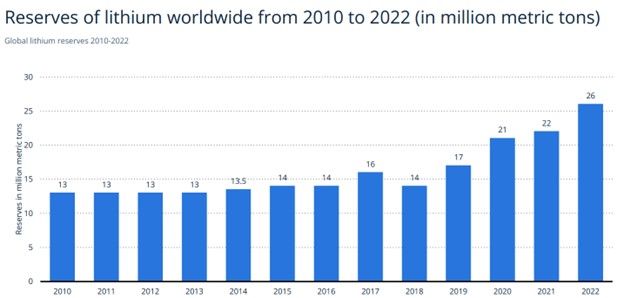

Globally, as of 2022 there were 26 million metric tons in lithium reserves, and owing to continued exploration, the volume of reserves has steadily increased and doubled since 2010.

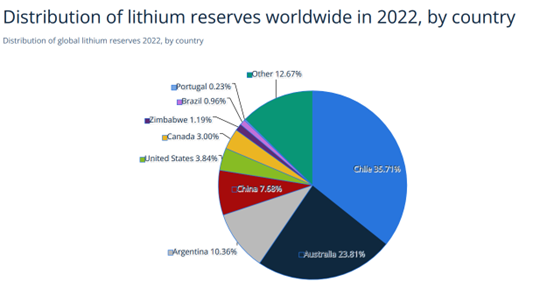

Of the global reserves, 4 countries hold just over 77% of the total: Chile (35.71%), Australia (23.81%), Argentina (10.36%) and China (7.68%). In addition, these four countries account for over 96% of the total mining production of lithium content worldwide.[3]

Top Players (in order of total lithium production volume)[4]

As of 2022, the top 6 main producers of lithium products were the following:

- 20% - Sociedad Química y Minera de Chile S.A. (NYSE: SQM)

- 16% - Albemarle (NYSE: ALB)

- 7% - Tianqi Lithium Corp.

- 6% - Jiangxi Ganfeng Lithium

- 4% - Allkem

- 3% - Livent Corporation (NYSE: LTHM)

- 44% - Other

Sociedad Química y Minera de Chile S.A., or SQM, is a publicly-traded corporation organized under the laws of the Republic of Chile and headquartered in Santiago, Chile. SQM is believed to be world’s largest producer of potassium nitrate and iodine and one of the world’s largest lithium producers. SQM operates two brine facilities from which it produces lithium carbonate and lithium hydroxide from highly concentrated lithium chloride sourced from the Salar de Atacama. Interestingly, SQM’s revenue pipeline is concentrated from the Asian continent, as 93% of SQM’s lithium product revenues are from Asian countries.[5]

Albemarle Corporation, ALB, was incorporated in the State of Virginia in 1993, and operates 4 lithium extraction facilities across the U.S., Chile and Australia. Of these four facilities, two extract lithium content via hard rock and two via brine. In addition, 87.8% of ALB’s net sales originated from foreign customers, with China, South Korea, and Japan accounting for 33%, 22% and 15% of net sales, respectively. [6]

Events & Trends

In 2022, the lithium production industry experienced increased revenue largely attributed to 462% higher average lithium prices in 2022 versus average lithium prices in 2021.[7]As 70% of lithium products’ end use is for electrical vehicles batteries specifically, the 2022 surge in lithium pricing was largely attributed to the year-on-year change in global plug-in electric vehicle sales (+56.9%) outpacing the year-on-year change in global lithium production (+21.5%).

Whether this supply imbalance will lead to further disruptions in lithium pricing depends on how adaptive lithium extractors can be to an explosive demand for electric vehicles. The major indicators that demonstrate a continued increase for the demand of lithium products are the following: (1) The global electric vehicle fleet in 2025 is expected to be 3.85x times larger than the existing 2022 fleet[8]; (2) globally, the share of new electric vehicle sales as a percentage of total new vehicle sales has consistently increased from 2.3% reported in 2018 to 14.0% reported in 2022[9]; (3) The political agenda across first world regions continues to incentivize and subsidize the purchase of electric vehicles by making it economically viable and attractive for individuals. This agenda has been consistent over the years and has been at the forefront of the international community’s sustainability commitments.

From a supply standpoint, the major arguments that indicate further disruptive pricing behaviour to the upside are following: (1) the majority of lithium mining production is concentrated in only a handful of companies – any disruption to any of these companies’ production activities could have considerable impacts on the industry’s lithium pricing. (2) New hard rock mining and brine facilities are capital intensive projects and take years before being fully operational. As an example, the largest lithium-carbonate producer, SQM, stands only to increase its lithium carbonate and lithium hydroxide capacity by 71.4% from 2022 to 2025[10], falling considerably behind the increase in estimated demand for EV batteries for the same time frame. (3) Thirdly, there has been relatively low volume in venture capital deployed in battery recycling facilities and research when compared to the volume of venture capital deployed in lithium and battery production facilities. [11]

Even though evidence suggests that supply of global lithium content will be tight in the short-term, the medium-term outlook suggests a normalization of supply and demand as multiple nations are pushing for a reinforcing stable supply chains within the lithium-ion battery market. The U.S. Department of Energy, specifically, has selected 12 lithium-based projects funded with $1.6 billion USD from the 2022 U.S. Bipartisan Infrastructure Law to support new commercial-scale domestic facilities to extract and process lithium, manufacture battery components, recycle batteries, and develop new technologies to increase U.S. lithium reserves.[12]

Concluding thoughts

In conclusion, adoption of lithium-ion batteries has moved from being an innovative technology that only a few brave souls dared to use in their vehicles (despite using it for the past decade in mobile phone technology) to quickly becoming the cornerstone of modern passenger vehicles. In addition, the support from government entities to subsidize individuals and the industry may give early-stage investors incentives to continue deploying capital into the market.

Lastly, the strong adoption of electric vehicles in 2022, which has been partially caused by high gasoline costs across the globe from brent and crude oil supply chain disruptions, has tightened the inventory of available lithium resources – causing a spike in lithium compound spot prices. Though spot prices have come down from their November 2022 levels, we expect prices to remain elevated versus 2019 and 2020 price levels as adoption of EVs continues to increase and one of the largest lithium ore extracting mines to cease production in 2024 (Mt Cattlin mine, Australia – Company: Allkem).[13]

How to gain exposure in portfolios?*

Investable assets that provide exposure to lithium-ion battery material producers and lithium-ion battery producers and users:

i) Global X Lithium & Battery Tech ETF (NYSEARCA: LIT)

ii) Amplify Lithium & Battery Technology ETF (NYSEARCA: BATT)

iii) WisdomTree Battery Value Chain and Innovation Fund (BATS: WBAT)

Please feel free to follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or equally licensed professional.

[1] Statista – 2023 Lithium Industry Worldwide: page 34.

[2]Statista – 2022 Battery Minerals Worldwide: page 7.

[3] Statista – 2023 Lithium Industry Worldwide: page 10.

[4] Statista – 2023 Lithium Industry Worldwide: page 26.

[5] SQM – Form 20F, For the fiscal year ended December 31, 2022: page 34.

[6] ALB - Albermarle Corporation 2022 10-K: page 131

[7]SQM – Form 20F, For the fiscal year ended December 31, 2022: page 33.

[8] Statista – 2023 Electric Vehicles Worldwide: page 12.

[9] Statista – 2023 Electric Vehicles Worldwide: page 15.

[10] SQM – Form 20F, For the fiscal year ended December 31, 2022: page 34.

[11] Statista – 2023 Electric Vehicles Worldwide: page 27.

[12] U.S Department of the Interior – US Geological Survey: Mineral Commodity Summaries 2023: page 18.

[13] NI 43-101 Technical Report - Mt Cattlin Spodumene Project: 16.5 Life of Mine Plan