Market Report: Africa & MENA - A regional opportunity for global telecoms

In search of top-line growth: How shifting global demographics and a historically underserved region be part of the next move for telecoms.

The Global Internet Market at a glance

In 2022, it is estimated that 5.30 billion people, or 66% of the world’s population, actively used the internet.[1] Take it back 10 years – in 2012, only 2.38 billion people, or 33% of the world’s population used the internet. That means since the release of ‘The Avengers’, ‘The Dark Knight Rises’ and ‘Skyfall’, an approximate additional 2.91 billion people now have access to the internet.

The internet penetration rate (the number of people who use the internet as a percentage of the total population) across different regions varies widely with Northern Europe, Western Europe and Northern America having 90%+ penetration rates while Middle Africa and Eastern Africa experiencing less than 30% penetration rates.[2]

Traditionally, access to the internet came from either personal or desktop computer devices, and back in 2013 72.6% of the share of daily internet time was used by computers rather than mobile devices. Fast forward 10 years, in Q4 of 2022, 57% of the share of daily internet time is now used by mobile phones.

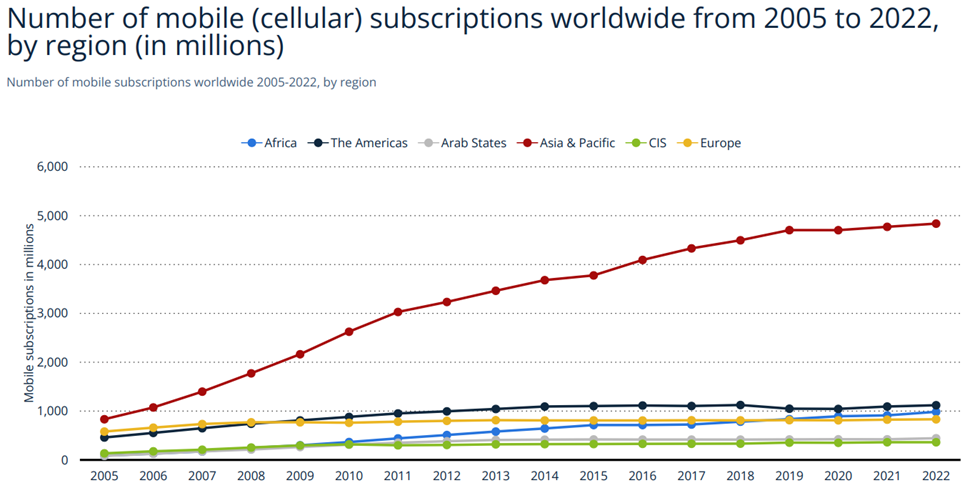

The accelerating usage of the internet via mobile devices can be attributed largely to four reasons: (1) Mobile data speeds have increased such that now consumers can now consume considerably more content (2) More mobile data infrastructure has made mobile data more accessible to more people (3) Mobile phone devices themselves have become larger, have faster computing times, and are equipped with easy-to-use touchscreens. (4) Asia & Pacific and African mobile device markets have exploded in the last 10-years. From 2012 to 2022 both these combined markets added an additional 2,079 million new mobile subscriptions – eclipsing the 278 million added across the rest of the world during the same time period. [3] (See chart below)

Geographic Trends

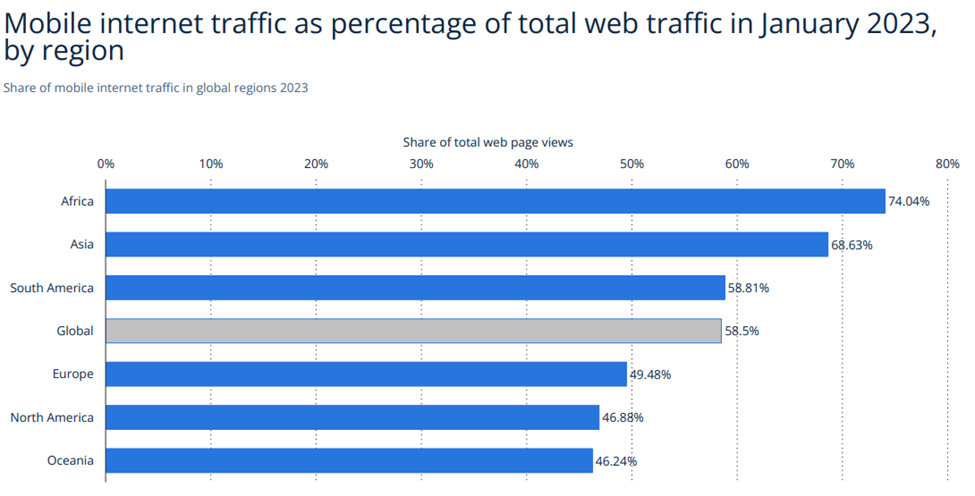

As we saw previously, the global trend towards mobile traffic versus desktop/laptop computers has been significant and has been mainly driven by the adoption mobile traffic in Africa and in the Asian Pacific region. Africa currently is the continent with the highest percentage of internet traffic attributed to mobile internet traffic (74.0%) rather than fixed broadband, followed by Asia (68.6%) and South America (58.8%). The continent with the lowest percentage being Oceania at 46.2%. [4] (See Chart Below).

The reason for this regional difference is because accessing the internet in lower-income countries, which mainly fall within the continents of Africa and Asia, via mobile data plans versus accessing internet via fixed broadband plans represents a financial commitment that is considerably less burdensome for consumers. In 2022, the cost for fixed broadband internet access in lower-income countries represented 31.1% Gross National Income (GNI) per capita, while data-only mobile broadband plans cost 9.4% of GNI per capita. Comparatively, in higher-income countries the cost of fixed broadband internet and data-only mobile broadband only cost 1.1% and 0.4% of GNI per capita, respectively.[5]

A positive trend is that in the countries where access to the internet is most expensive, prices have been dropping. From 2021 to 2022, in the four economies where the data-only mobile broadband basket cost more than 20% of GNI per capita, GNI per capita basket prices in this group dropped on average by 36%, most notably in the Central African Republic (from 41.0 to 23.8% of GNI per capita), Equatorial Guinea (from 23.5 to 10.3% of GNI per capita) and Zimbabwe (from 30.0 to 18.4% of GNI per capita), in all cases due to both the plans becoming cheaper as well as growing average income in the country. The price of the data-only mobile-broadband basket in the 14 economies where it cost between 10 and 20% of GNI per capita in 2021 dropped on average by 2%. Similarly, this decrease was most frequently due to plans becoming cheaper in real terms coupled with favourable macroeconomic conditions.[6] Lastly, as Africa and the Asia-Pacific have experienced annual growth rates of 8.9% and 8.7%, respectively, in median wealth per capita over the last few years, versus the world’s 8.1% growth rate, a drop in prices for mobile internet access in real terms is likely to continue across the region.[7]

Where is the opportunity and what is the opportunity?

So, what are the opportunities for the global internet market, where do they lie and who is in position to make good use of these opportunities? With falling costs of mobile data plans in relation to fixed broadband in lower income regions, the continued transition of the access to the internet from fixed devices to mobile devices is likely to persist.

Who will capture the market for the growing access to the internet via mobile devices?

To first answer this question we must first understand the demographic changes that are occurring across the globe. According to the World Bank and UN the world population is expected to continue to increase but at a slower rate than in previous decades. In 2022, the two most populous regions were both in Asia: Eastern and South-Eastern Asia with 2.3 billion people (29% of the global population), and Central and Southern Asia with 2.1 billion (26%).[8]

Countries of sub-Saharan Africa are expected to continue growing through 2100 and to contribute more than half of the global population increase anticipated through 2050. In Sub-Saharan Africa region, the countries of Tanzania, Democratic Republic of Congo, Nigeria and Ethiopia are projected to be the four largest contributors to world population growth; those same 4 countries are likely to be in the top 8 countries contributing the most to global population growth.[9] By 2050, the world population is expected to plateau considerably and reach 9.7 billion, 1.7 billion higher than the current world population.[10]

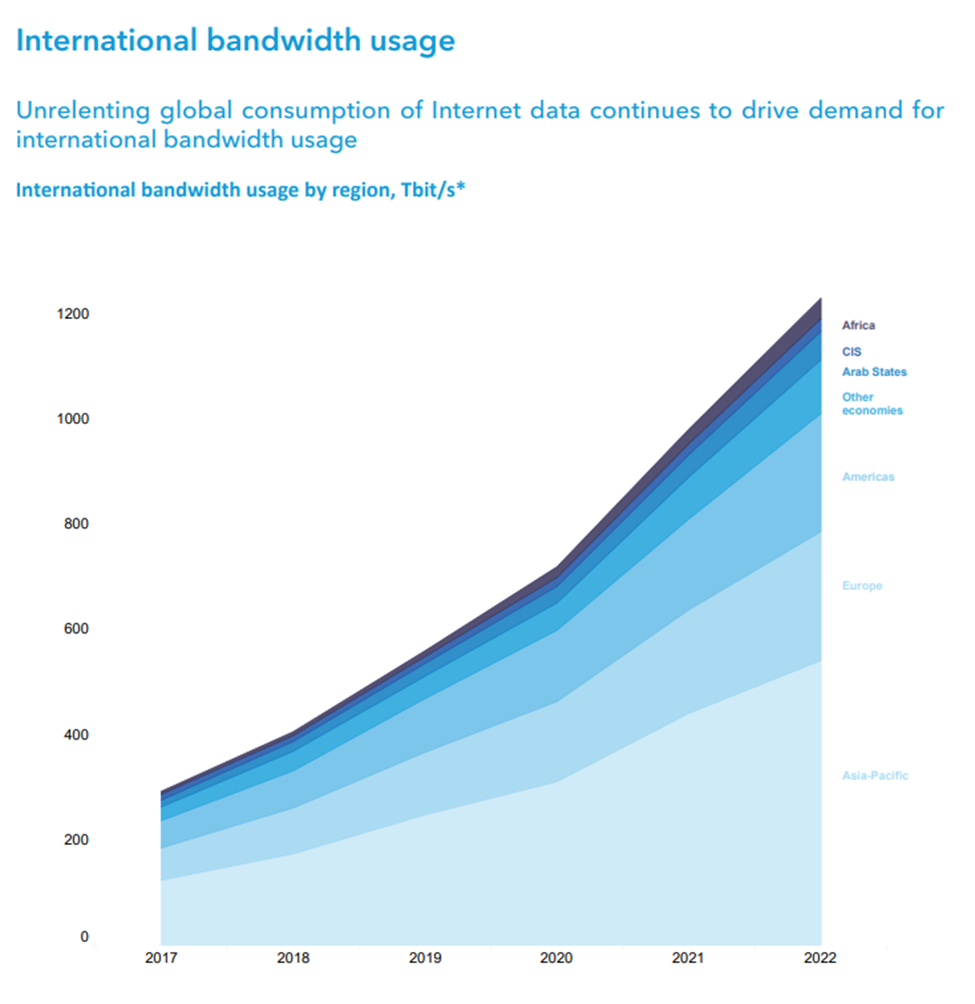

The compound average growth rate over the past five years is 33% for overall international bandwidth usage and 22% for usage per Internet user. In Africa, international bandwidth usage shows the fastest growth (37%), while the fastest growing region in terms of bandwidth usage per Internet user is the Americas (26%).[11]

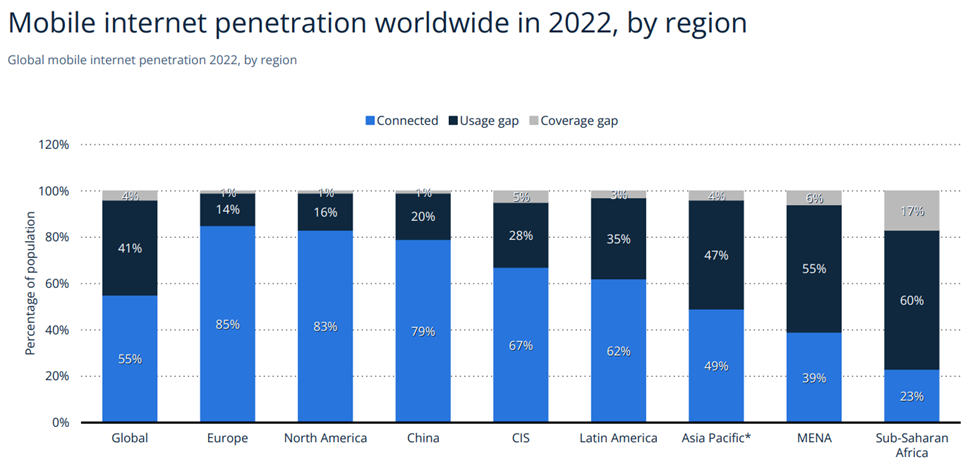

In addition, as we have found previously, the mobile internet penetration rate by region varies considerably with developed nations in the Americas, Europe and some of Asia having the highest and Sub-Saharan Africa, Middle East & North Africa (MENA) and certain nations of the Asia Pacific with the lowest. As shown above, the regions with lowest mobile internet penetration rates equally have largest usage gaps, which illustrates the share of the population covered by mobile data networks but who do not have access due to barriers such as affordability or a lack of digital skills.[12]

In conclusion, attractive demographic trends, the potential for closing the existing usage gap and above average growth in bandwidth usage suggest that the regions of Sub-Saharan Africa and certain MENA nations are poised to be the source of new top-line growth (revenue) for telecom firms ready to take advantage of historical underservice in the regions.

Thus, as the regions of Sub-Saharan Africa and MENA grow in both the number of people and in terms of wealth, we expect that the best positioned internet service providers are the ones that (I) have already established a foothold in the African/Asian telecom market, (II) are looking to expand their coverage across the region specifically in countries with high usage gaps (III) have considerable market share and pricing power in the respective countries they operate in and (IV) are looking to prioritize growing their mobile broadband versus their fixed broadband users.

Market Participants

With this in mind, we looked at 3 market participants that stand to benefit from the opportunity in the region and that satisfy the four conditions mentioned above.

1. MTN Group (JSE: MTN) – Founded in South Africa and with the largest mobile customer base (289 million) in the region, MTN Group Limited is a publicly owned telecom giant providing mobile and fixed broadband services in Africa and the Middle East.

From 2021 to 2022, it increased its mobile customer base by 5.1% (though declining from 2020 to 2021) while simultaneously increasing total revenue by 14.0% and net income by 42.8%.

2. Vodafone (LON: VOD) – With the 2ndlargest mobile customer base (184.5 million) in the region, Vodafone is a European and African telecommunications company operating mobile and fixed networks in 17 countries (and have stakes in a further 5 countries through our joint ventures).

Though Vodafone has grown its mobile customer base in Sub-Saharan Africa and MENA in 2021 and 2022 by 5.7% and 3.7%, respectively, Vodafone’s top line revenue has stagnated over the last couple of years and year-on-year revenue declines incurred from large European markets has been offset by the growth in African markets.

3. Orange (EPA: ORA) – With the 3rd largest mobile customer base (143.1 million) in the region, Orange experienced revenue growth of 25% over a three-year period for the Middle East and Africa. In addition, in 2021 and 2022 it increased its mobile customer base in region by 5.3% and 5.8%, respectively.

The Group sees the Africa and Middle East region as a major growth market and is investing heavily to reap build on this momentum to take advantage of this high-potential market and is aiming to achieve an average annual revenue growth of 7% between 2022 and 2025 for the region.[13]

Commentary

In terms of who could pull out ahead, in the past couple of years, MTN Group customer growth rate fell short of Vodafone’s and Orange’s rates; in addition, with additional revenue generated from European sales, both Vodafone and Orange generated 4.56x and 4.34x more in annual revenues versus MTN. Thus, from a capital deployment perspective Vodafone and Orange are better positioned to take advantage of the regional usage gap by acquiring or securing long-term leases on network infrastructure.

Though Vodafone and Orange have similar levels of cash availability (Vodafone current ratio: 0.92, Orange current ratio: 0.88), as Vodafone struggles to fix its failing European growth strategy (specifically in Germany and Spain), Orange could secure further market share in the region.

Please feel free to follow us on Instagram at https://www.instagram.com/blue_portal_insight/and don’t hesitate to contact us at: blueportalinsight@gmail.com

*This is not investment advice. Blue Portal Insights does not provide investment advice but rather provides commentary on market movements and insight into industry information. For investment advice, please refer to your financial advisor or equally licensed professional.

[1]Statista – Internet Usage Worldwide 2022: page 4

[2]Statista – Internet Usage Worldwide 2022: page 10

[3]Statista – Mobile Telecoms Services in Africa 2023: page 5

[4]Statista – Internet Usage Worldwide 2022: page 53

[5]ITU – The affordability of ICT services 2022: page 4

[6]ITU – The affordability of ICT services 2022: page 4

[7]Credit Suisse – Annual Wealth Report 2022: page 25

[8] UN – World Population Prospects 2022 (Summary of Results): page i.

[9] UN – World Population Prospects 2022 (Summary of Results): page i.

[10] The World Bank – Population estimates and projections.

[11] ITU – Measuring Digital Development Facts and Figures 2022: page 22

[12] Statista – Internet Usage Worldwide 2022: page 43

[13]Orange – Integrated Annual Report 2022: page 67